- Bitcoin whale entities are on the verge of making a comeback.

- How will this help Bitcoin HODLers?

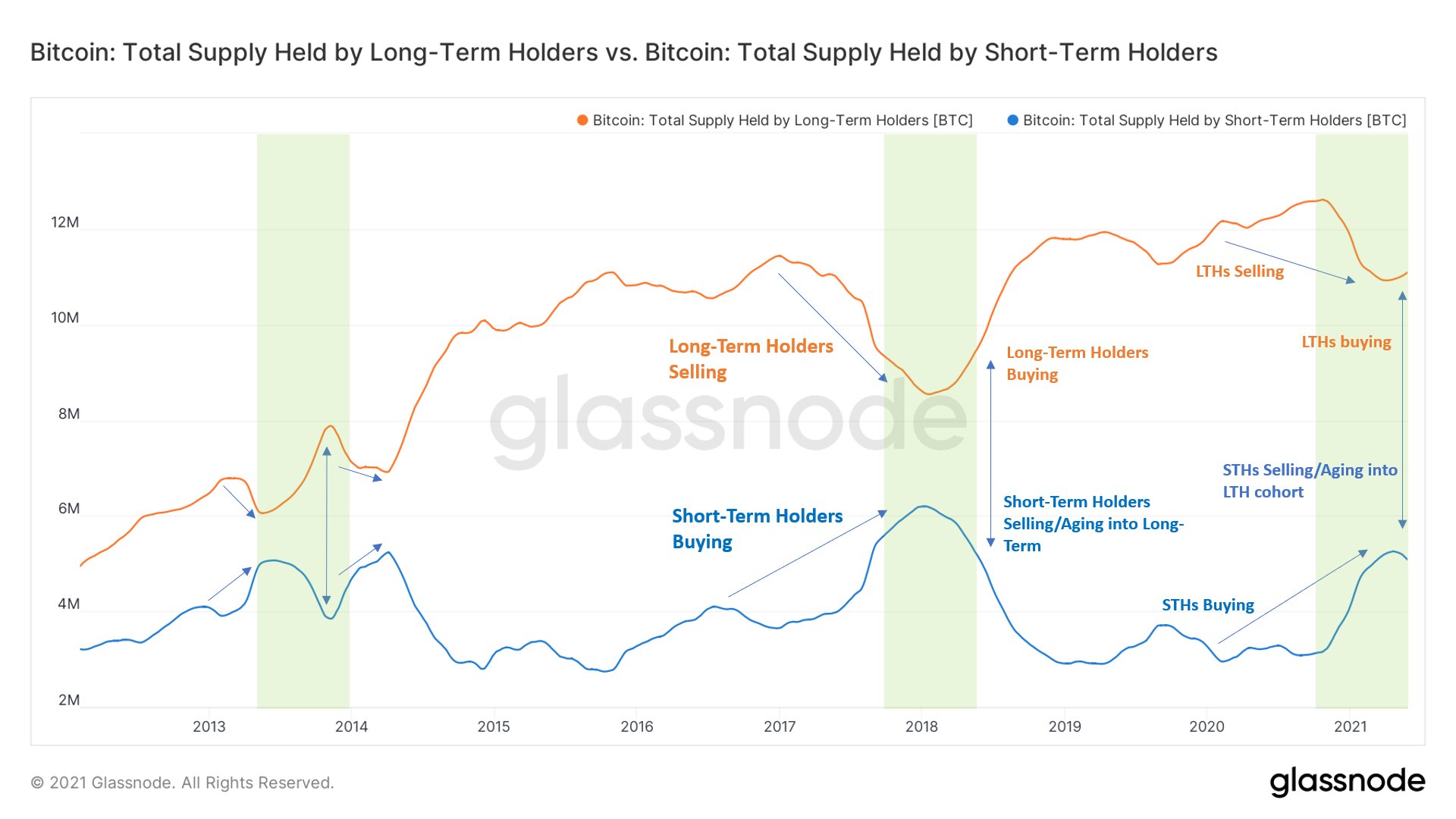

Bitcoin whale entities are making a comeback into the crypto market. They are a single network participant who controls a cluster of addresses. They also hold a large number of bitcoins. Their movements in the crypto market have the potential to manipulate currency valuation. The number of coins owned by the whale entities rose by 80000 to 4.216 million BTC on July 2, 2021, the highest level since May 2021. The number of whale entities has also jumped to a three-week high of 1,922.

The whale entities held a record high balance of 4.543 million BTC on Feb 8, 2021. Following this, BTC reached an all-time high of $64,829 in mid-April. Then the entities commenced selling, and subsequently, their balance declined to 4.12 million BTC.

Now, these whale entities are on the verge of growing their BTC balance. A single trade made by these whales can cause enormous price changes. And that’s a piece of good news for the Bitcoin HODLers. The last time when the whale entities increased their wallet balance, demand for BTC climbed high and, it increased the price. If these entities keep adding more BTCs to their pocket, it’s going to be a great thing for Bitcoin HODLers. Because the HODLers might as well enjoy the bull run.

BitcoinNews.com is committed to unbiased news and upholding journalistic codes of ethics. For more information please read our Editorial Policy here.

Follow BitcoinNews.com on Twitter: @bitcoinnewscom

Telegram Alerts from BitcoinNews.com: https://t.me/bconews

Image Courtesy: Bitcoin News

The post Bitcoin HODLers Among Whales on the Rise appeared first on BitcoinNews.com.

from BitcoinNews.com RSS Feed

via TOday BItcoin New